Laptop depreciation calculator

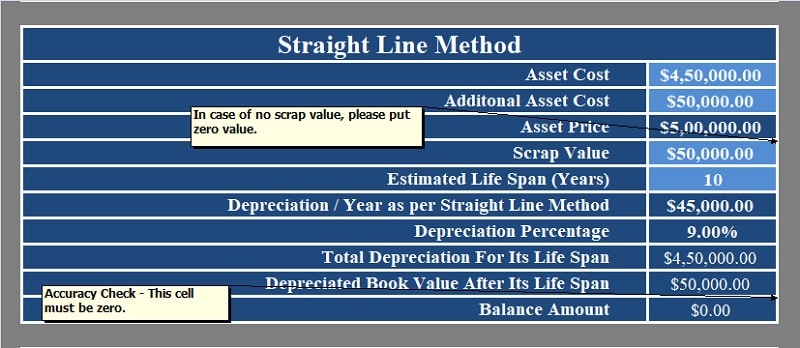

The calculator should be used as a general guide only. Subtract the residual value from the cost of the asset to calculate the base for the depreciation.

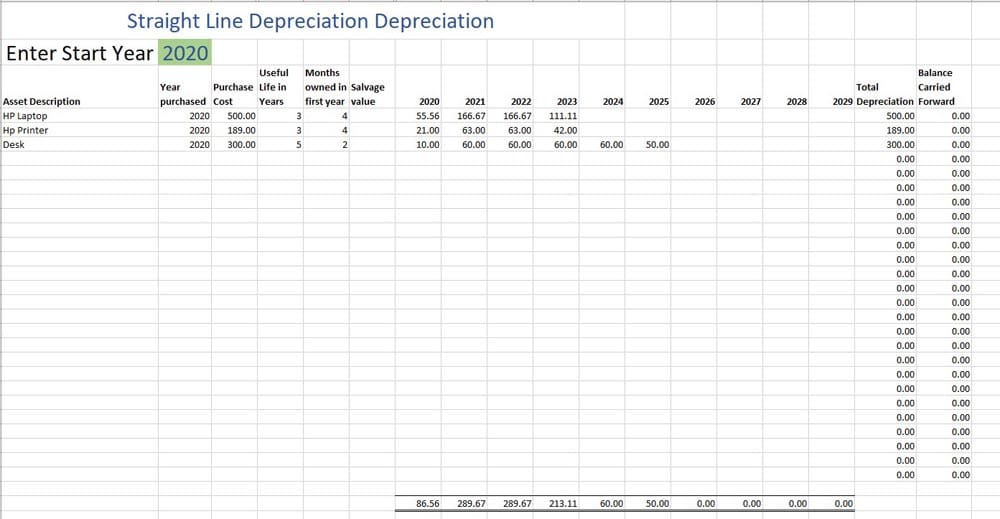

Straight Line Depreciation Calculator For Determining Asset Value

Cost of the asset Useful life of the asset or number of.

. ATO Depreciation Rates 2021. Not Book Value Scrap value Depreciation rate Where NBV is costs less accumulated depreciation. Compare depreciation amounts between the prime cost and diminishing value methods determine balancing adjustment amounts save your calculations so they automatically.

Depreciation asset cost salvage value useful life of asset 2. So simple depreciation is the easiest one to go. Where the cost is more than 300 then the depreciation.

And if you want to. While all the effort has been made to make this. Also includes a specialized real estate property calculator.

Depreciation Calculator The calculator should be used as a general guide only. In the example 520 minus 65 equals 455. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

The formula to calculate depreciation through the double-declining method is. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Whether you use GAAP MACRS or activity the calculation of depreciation for an asset requires the same set of variables.

There are many variables which can affect an items life expectancy that should be taken into consideration. If you want to know the depreciation rate for an asset youll need to know the date you acquired the asset and then confirm that you dont know the depreciation rate. Further you can also file TDS returns.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Mobileportable computers including laptop s tablets 2 years. This Excel worksheet will calculate standard depreciation using various methods each with its own benefits and drawbacks.

Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the. The calculation methods used include. Now comes the various methods for calculating depreciation.

For example if you have an asset. All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300. There are many variables which can affect an items life expectancy that should be taken into consideration.

Percentage Declining Balance Depreciation Calculator. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. There are really two that Ill go through simple and double-declining balance.

Divide the depreciation base by the. Double Declining Balance Method.

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Calculator

Free Depreciation Calculator Online 2 Free Calculations

Capital Cost Allowance Cca For Canadian Assets Depreciation Guru

Depreciation Rate Formula Examples How To Calculate

Top 3 Online Depreciation Calculator To Calculate Depreciation

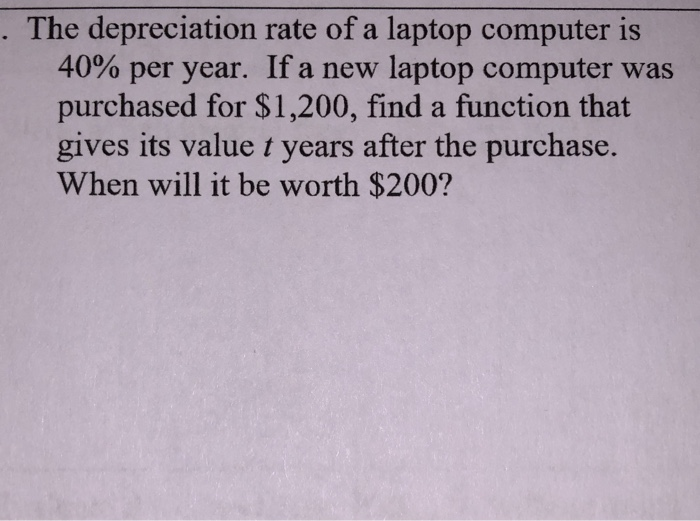

Solved The Depreciation Rate Of A Laptop Computer Is 40 Chegg Com

Sat Math Multiple Choice Question 308 Answer And Explanation Cracksat Net

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Calculator Calculate Depreciation Easily Online

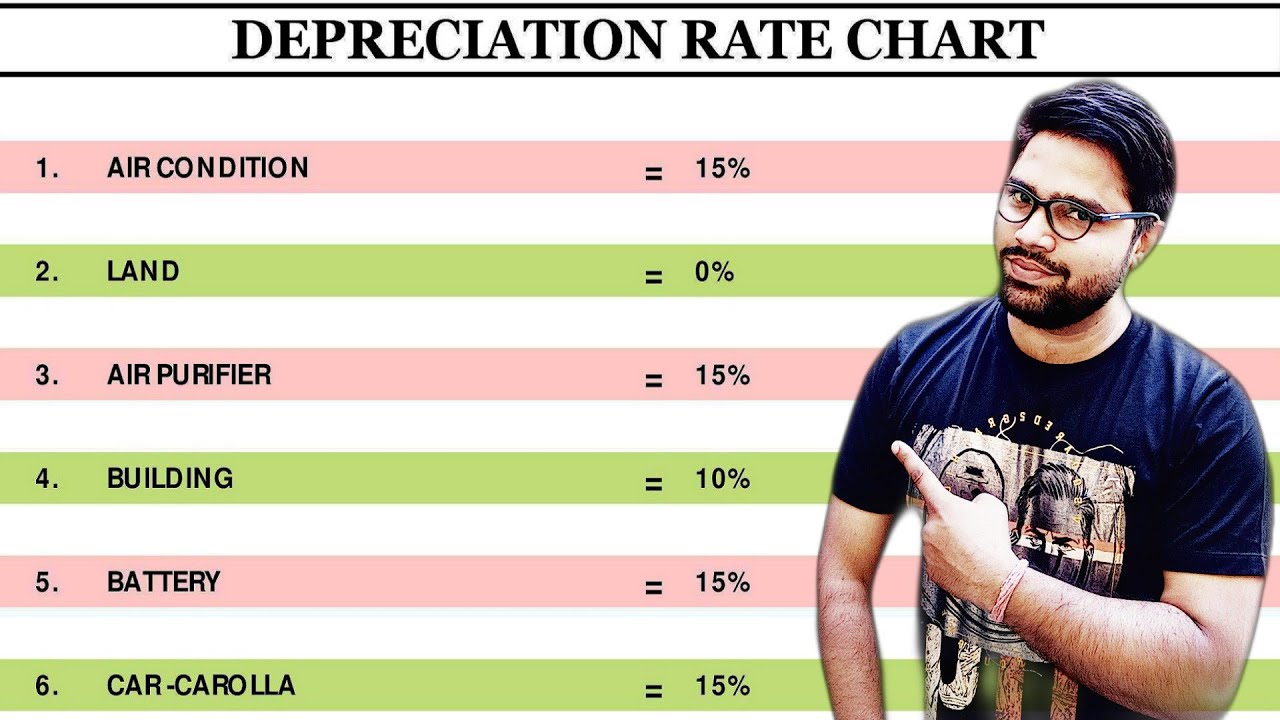

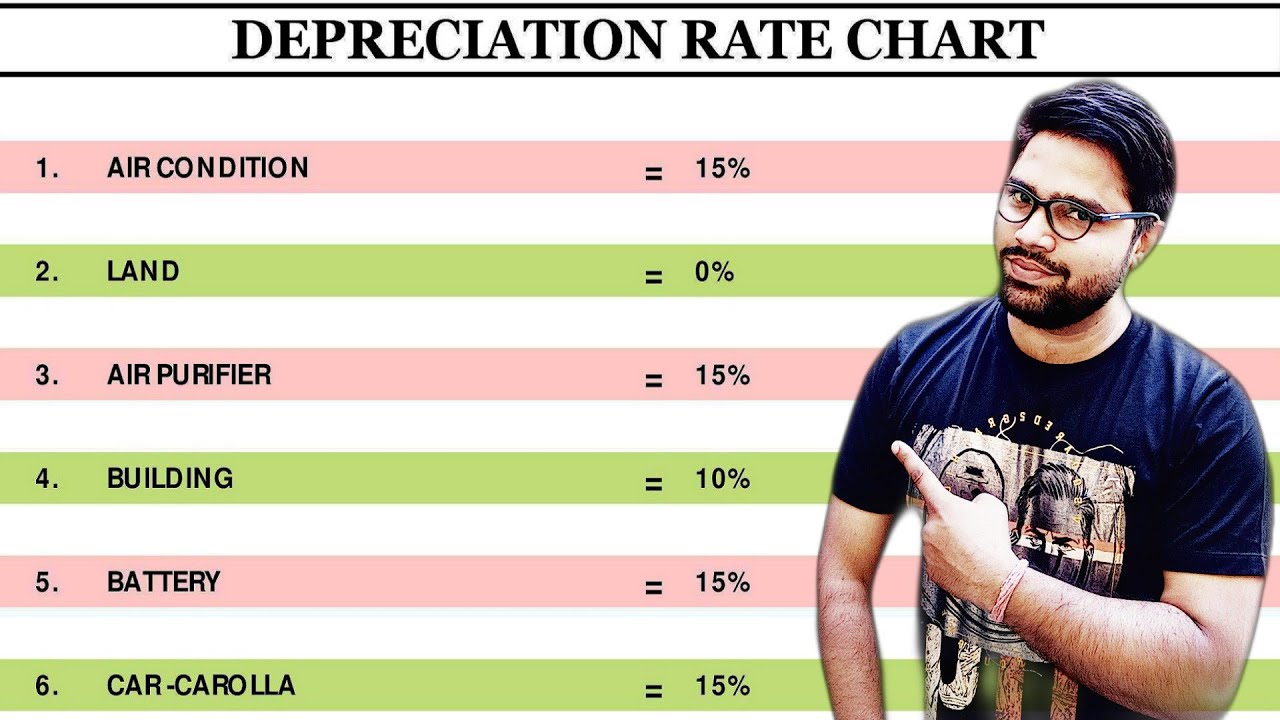

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator With Formula Nerd Counter

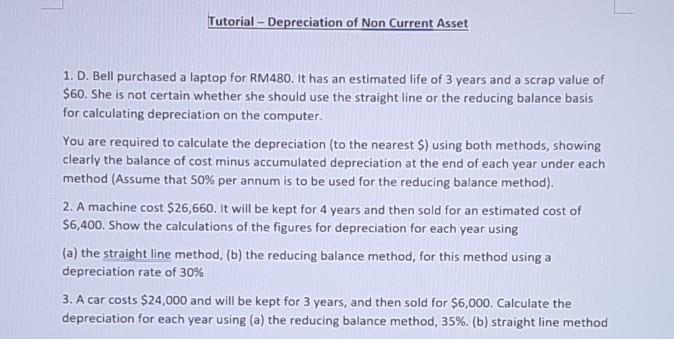

Solved Tutorial Depreciation Of Non Current Asset 1 D Chegg Com